Invest in Your Future Starting With Just $5!!Category Archives: Saving Money

Are you poor or wealthy?

Financial Tips Everyone Must Read

Everyone needs financial advice at some point. Follow these financial tips to get started in the right direction.

1.Max your 401k or other employee contribution OR at least enough to get your employer’s maximum match. Don’t throw away free money. This can be thousands of dollars you are leaving on the table.

a. Know where your money is invested in your 401k (common stocks, bonds, international stocks, etc.). Choosing the wrong investments can lose you 1000s of dollars. Also if you are not checking your ira with https://www.sofi.com/roth-ira-calculator/, you might not get as much money as you have been getting.

2. Get inexpensive, well-diversified mutual funds such as those in Vanguard (VTSAX). If you can’t invest a lot, start here.

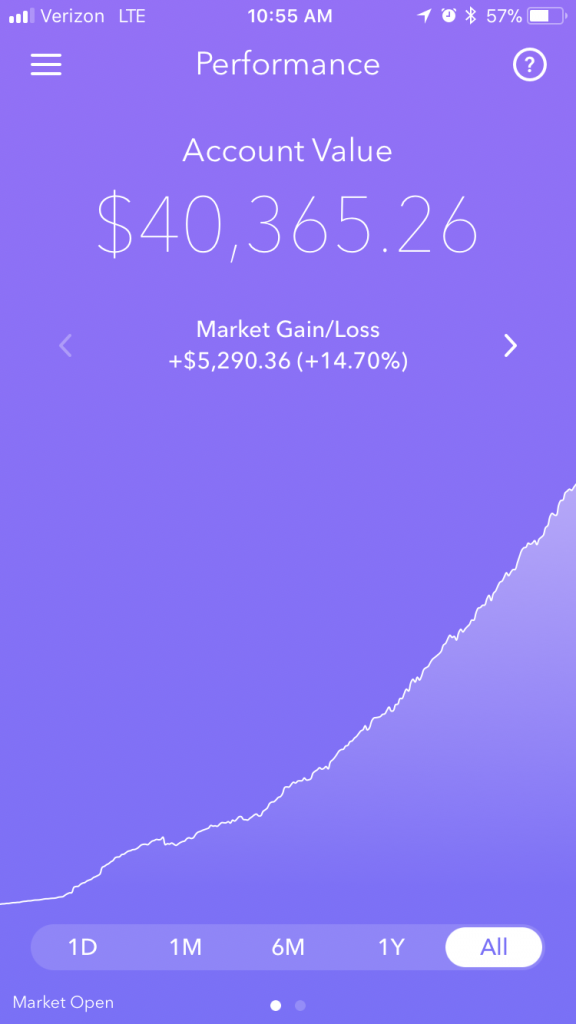

This app (get $5 just for signing up) allows you to invest small amounts to grow wealth over time. It even has a cool recurring investment feature where you can invest an X amount from your account every day/week/month. Set it and forget it. Fees are low as well.

See below how I used this app to invest a good amount with a good return in a few short years:

Sign up here and start investing today —-> I Want to Invest My Spare Change Now!

3. Save 20% of what you make. A large income does not equal wealth. Wealth is what you save, not what you spend or buy. The next financial tip is very important.

4. If you have credit cards, always pay in full every month. I only have debit cards.

5. Buy used cars in ca$h. The certified used cars these days are solid and cost a lot less. You save paying less for a used car AND no interest charges for a car loan.

6. Max out tax-advantaged vehicles like Roth, SEP and 529s.

7. Make sure you know your fees. High fees can eat away at your investment earnings. Avoid actively managed funds.

8. Only choose a fiduciary as a financial advisor.

9. Read some basic financial books:

a. “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy.”

-develops the right mindset to achieve wealth

The success stories speak for themselves in this book from money maestro Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters…

Use it for yourself or give it as a gift (makes a great wedding gift).

-great for high earning professionals especially physicians

d. “The Bogleheads’ Guide to Investing”

-a slightly irreverent, straightforward guide to investing for everyone. The book offers sound, practical advice, no matter what your age or net worth.

e. “Retire Inspired: It’s Not an Age, It’s a Financial Number”

-In Retire Inspired, Chris Hogan teaches that retirement isn’t an age; it’s a financial number an amount you need to live the life in retirement that you’ve always dreamed of. With clear investing concepts and strategies, Chris will educate and empower you to make your own investing decisions, set reasonable expectations for your spouse and family, and build a dream team of experts to get you there.

10. Read these other sources and stay educated and gain valuable financial tips. (Money Magazine, Business Insider, Kiplingers, Money Mustache, Bogleheads, The Penny Hoarder). These give investing, business and saving advice.

11. Learn what opportunity cost is and think about this in everything you purchase. It’s defined as “the loss of potential gain from other alternatives when one alternative is chosen”. For example, if you choose to buy a Michael Kors purse for $700, that is $700 that is gone forever. It cannot be invested or saved.

12. Do a monthly budget. Set average projected expenses and try to stay in those boundaries. Try to make saving and investing more joyful than spending. EveryDollar is a great tool.

13. Acquire some passive income streams. Make your money work for you by working smarter, not harder. The average millionaire has 5+ income streams.

14. Try to understand taxes as much as possible. Do taxes yourself for as long as possible (or find a good CPA). People who don’t understand the tax system never become wealthy because they don’t realize that a major way to lose money is through taxes.

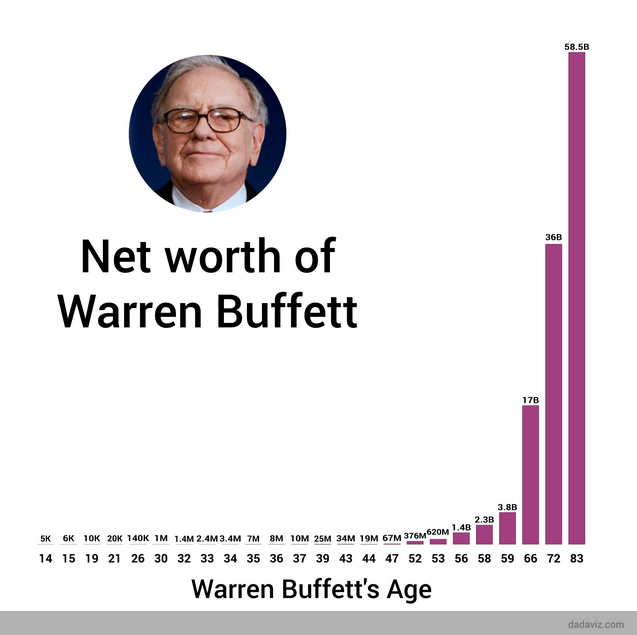

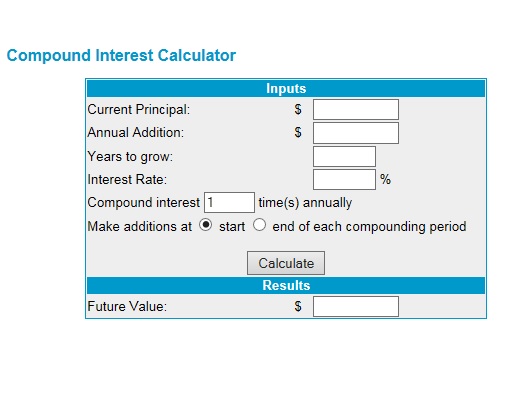

15. Understand the power of compound interest. Wealth is like a snowball that starts small for a while but sooner or later will hit an inflection point leading to big gains. Knowing this early can be better than any financial tip anyone can give you!

When you get depressed that your friends in the neighborhood appear “wealthy” because they are driving luxury cars and living in 5000 sq. foot houses, remember this calculator and never forget it. For example, if you chose to save $30,000 buying a reasonable car such as a Honda as opposed to a luxury car and invested that money, with a 7% interest rate and growing over 20 years, you would have $116,090.53. Click on image to use the calculator and play with some numbers.

16. Keep ALL of your receipts and know the deadlines of when you can return purchases. I used to lose a lot of money being unorganized. Some stores will only give you store credit or significantly much lower than what you paid without a receipt.

17. Don’t donate to everyone and your mother. I see people donating to every cause possible when they can barely afford to pay their own bills. Donate when you can and as much as you think you can. Nowadays, almost every major retailer tries to get a donation form you as you checkout. I just say “no thanks”. This could be thousands of dollars that you could save and invest. I am not saying to not be generous, but be generous when you can afford it and give to a cause you believe in.

18. Sign up for rewards programs and/or store debit cards with stores you visit frequently. You can get discounts, coupons and other special perks. My favorite is the Target RED card. You can get the credit or debit card. I have the debit card which saves me 5% on everything I purchase and it comes right out of my checking account. It’s secure and you even get discounts on sale items. Apply for yours here.

Benefits:

- 5% off everything in store and online. This can add up quickly if you shop at Target a lot.

- Free shipping on all online orders.

- Custom offers for what you usually shop for. Coupons for stuff you buy.

- Special promotions only for RED card holders like early Black Friday deals.

19. Avoid late fees on your bills. The easy solution is to setup auto-pay from your bank account. This will save you time and money.

20. Move. If you live in a high cost of living area, a lot of your money is going to housing, utilities and food. That can be $1000s of dollars that could be invested. Be smart about where you live.

Hope you found these financial tips useful. Now, put them into action and create a great life for yourself!

Final thoughts from a video by MJ Harris:

SHARE this if you enjoyed it and know someone who could learn from it.

What is your advice for financial security? COMMENT below.

How to Get the Lowest Car Insurance Rates

You finally got your dream car or at least your first car. But, before you can take road trips or hang out with friends and create amazing memories, you’ll need car insurance. Here are some great ways to get the lowest car insurance rates:

-Different companies have different rates based on a variety of factors.

-Use an auto insurance quote finder to compare rates of the top companies.

2. Avoid Gaps in Coverage

If you are switching policies, make sure you are completely covered at all times. If you let your insurance coverage lapse by forgetting to make the premium payments, your rates are likely to be increased.

3. Maintain Good Credit

Insurance companies typically check your credit score when determining your insurance rates because they have found a correlation between bad credit and the likelihood of making a claim

4. Drive Less

Many companies offer a low-mileage discount for drivers who have a short commute or drive few miles each year.

5. Request a High Deductible

One of the easiest ways to reduce your car insurance premiums is to increase your deductible. Just make sure you have the funds to pay the deductible if you get in an accident.

6. Claim all Your Discounts

If your car has extra anti-theft or safety features such as anti-lock brakes, most insurance companies will give you a discount on your premiums. You may also be eligible for a discount if you have taken a defensive driving class or, if you are a student, you have good grades

7. Drive Safely

Of course you should drive carefully to avoid accidents and tickets anyway, but bad driving can also raise your insurance rates or even lead to a nonrenewal of your policy. While too many speeding tickets can cause a problem, causing an accident will typically raise your insurance costs by as much as 40%.

8. Consider Moving

While this may be a bit drastic, auto insurance rates vary widely from one location to another because of the likelihood of an accident or a theft. In general, car insurance rates are lower in rural areas, so you may want to look into the potential for higher or lower insurance rates if you are thinking of moving.

9. Work with One Insurance Company

After you shop around for insurance rates, choose one company for all your insurance needs. Most offer a discount for combining car and homeowners or renters insurance with one provider.

10. Lower Your Coverage

The Insurance Information Institute (III) suggests dropping collision and/or comprehensive insurance on older cars to save money. As a rule of thumb, III says that if your car is worth less than 10 times the premium, it may make sense to drop that coverage.

Conclusion

The important thing to recognize is that car insurance should be customized to meet your needs. Consulting with an insurance agent can be the best way to make sure you are taking advantage of every possible discount and that you and your car are still adequately covered.

References: Investopedia

Secrets the Millionaire Next Door Won’t Tell You

Although having a million bucks isn’t as impressive as it once was, it’s still nothing to sneeze at.

In fact, Reuters reports that in 2009 there are 7.8 million millionaires in the United States. That’s a lot of people and the odds are one or two of them are living near you.

Heck, one of them might even be your neighbor. In fact, the odds are very good that it is your neighbor.

But, Len, you don’t know my neighbor. That guy doesn’t look anything like a millionaire.

Well, guess what? A millionaire who is truly financially savvy won’t be easily recognizable.

1. He always spends less than he earns. In fact his mantra is, over the long run, you’re better off if you strive to be anonymously rich rather than deceptively poor.

2. He knows that patience is a virtue. The odds are you won’t become a millionaire overnight. If you’re like him, your wealth will be accumulated gradually by diligently saving your money over multiple decades.

3. When you go to his modest three-bed two-bath house, you’re going to be drinking Folgers instead of Starbucks. And if you need a lift, well, you’re going to get a ride in his ten-year-old economy sedan. And if you think that makes him cheap, ask him if he cares. (He doesn’t.)

4. He pays off his credit cards in full every month. He’s smart enough to understand that if he can’t afford to pay cash for something, then he can’t afford it.

5. He realized early on that money does not buy happiness. If you’re looking for nirvana, you need to focus on attaining financial freedom.

6. He never forgets that financial freedom is a state of mind that comes from being debt free. Best of all, it can be attained regardless of your income level.

7. He knows that getting a second job not only increases the size of your bank account quicker but it also keeps you busy – and being busy makes it difficult to spend what you already have.

8. He understands that money is like a toddler; it is incapable of managing itself. After all, you can’t expect your money to grow and mature as it should without some form of credible money management.

9. He’s a big believer in paying yourself first. Paying yourself first is an essential tenet of personal finance and a great way to build your savings and instill financial discipline.

10. Although it’s possible to get rich if you spend your life making a living doing something you don’t enjoy, he wonders why you do. Life is too short.

11. He knows that failing to plan is the same as planning to fail. He also knows that the few millionaires that reached that milestone without a plan got there only because of dumb luck. It’s not enough to simply declare that you want to be financially free.

12. When it came time to set his savings goals, he wasn’t afraid to think big. Financial success demands that you have a vision that is significantly larger than you can currently deliver upon.

13. Over time, he found out that hard work can often help make up for a lot of financial mistakes – and you will make financial mistakes.

14. He realizes that stuff happens, that’s why you’re a fool if you don’t insure yourself against risk. Remember that the potential for bankruptcy is always just around the corner and can be triggered from multiple sources: the death of the family’s key bread winner, divorce, or disability that leads to a loss of work.

15. He understands that time is an ally of the young. He was fortunate enough to begin saving in his twenties so he could take maximum advantage of the power of compounding interest on his nest egg.

16. He knows that you can’t spend what you don’t see. You should use automatic paycheck deductions to build up your retirement and other savings accounts. As your salary increases you can painlessly increase the size of those deductions.

17. Even though he has a job that he loves, he doesn’t have to work anymore because everything he owns is paid for – and has been for years.

18. He’s not impressed that you drive an over-priced luxury car and live in a McMansion that’s two sizes too big for your family of four.

19. After six months of asking, he finally quit waiting for you to return his pruning shears. He broke down and bought himself a new pair last month. There’s no hard feelings though; he can afford it.

So that’s it. Now you know what your millionaire neighbor won’t tell you. You can also as well learn about your future by getting a psychic session from psychic readings charlotte nc.

Original source: Business Insider![]()

![]()

![]()

![]()

![]()

![]()

10 Ways to Save Money

![]()

![]()

![]()

![]()

![]()

![]() I’ll go over 10 ways to save money that I have discovered from life experiences and research. Apply some and save a lot of money.

I’ll go over 10 ways to save money that I have discovered from life experiences and research. Apply some and save a lot of money.

1. Rent movies from your local library, Redbox, Netflix or Amazon Prime. Your local library is FREE. Redbox kiosks are at high traffic businesses such as McDonald’s, Walgreens and grocery stores. They cost 1.00 for regular DVDs and 1.50 for Bluray for 24 hrs. You can get a Netflix subscription for as little as $8 per month and they have a FREE trial too. Amazon Prime has a free 30 day trial that includes unlimited instant streaming of movies and TV shows, anywhere, anytime and unlimited FREE two-day shipping on millions of items with no minimum order size. You can also rent video games from Redbox or use a service like GameFly (FREE trial) that charges a low monthly fee. Why pay over $50 per video game when you can rent to see if you actually like the game.

2. Use sites like Groupon, Living Social, Amazon Deals and Google Offers to get amazing deals on things you do locally. For example you can get $30 to spend at your favorite restaurant for $15. I suggest signing up for all these services as they offer deals from different local businesses.

3. Get great travel discounts using sites sites like Gate1 Travel, Travelzoo, Cheap Caribbean, Groupon Getaways and Living Social Escapes. They have great package deals that save you a lot of money.

4. Download digital books on a device such as the Kindle, the Ipad or your smart phone and save a lot more than a physical book. Plus, you can take thousands of books with you when you travel.

5. Use price comparison sites such as NextTag and Pricegrabber. You will find the best price this way.

6. Use Fiverr to get many tasks done for only $5. You can get articles written, logos made, search engine optimization done with help from the seo agency YEAH! Local, almost anything anyone will do for $5. CLICK on any image below and see what can be done for you for ONLY $5!

7. Shop at stores like Marshall’s, Ross , TJ Maxx and Burlington Coat Factory. They have great brands at over 50% off. You may not have the latest styles, but you will save a lot of $$$.

8. Use Coupon sites to save money on things you buy every day.

9. Look at classified ad sites such as Craigslist and Backpage for local stuff for sale. Many people sell good quality stuff for a low price here.

10. I have saved the best for last…..AMAZON. There is no other site on the internet with the variety of products and trust that AMAZON has. With the amout of volume they have, you can find great deals on almost anything. For example, you can get a Kindle Fire device and order from 1000s of Kindle Ebooks at a fraction of the cost of paperback books.

Summary of Companies:

ENTERTAINMENT/LEISURE

* Redbox

* Netflix

* GameFly

* Kindle

LOCAL

* Groupon

* Amazon Deals

* Google Offers

* Craigslist

* Backpage

TRAVEL

* Travelzoo

* Gate1 Travel

SHOPPING

* AMAZON

* NextTag

* Pricegrabber

* Marshall’s

* Ross

* TJ Maxx

* Burlington Coat Factory

MISCELLANEOUS

* Fiverr

* Coupons

If you saved any money reading this post or think others can save money, please use the SHARE buttons below.