Invest in Your Future Starting With Just $5!!Category Archives: Business

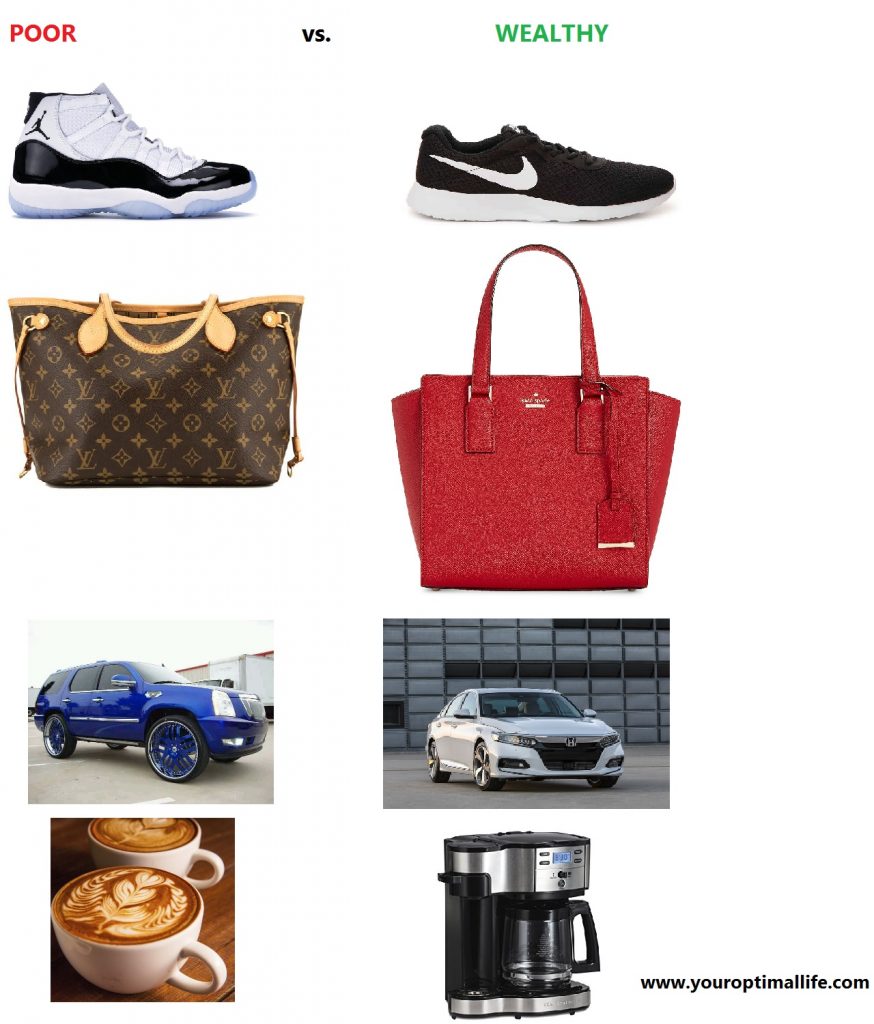

Are you poor or wealthy?

Is Acorns Worth It? Invest with Pennies!

What is Acorns?

It is a mobile app you can download that invests your spare change. The app is tied to your bank account and credit cards and rounds up your daily purchases and invests the change into a portfolio of diversified ETFs. It is ideal for young, new investors that are worried about huge fees and initial investment buy ins. You can start with as little as $5.

It costs about $15 a year if <$5000 invested then .275% beyond that.

Setup is easy.

- Download the app and create an account.

- Complete your profile.

- Link you bank accounts and credit cards.

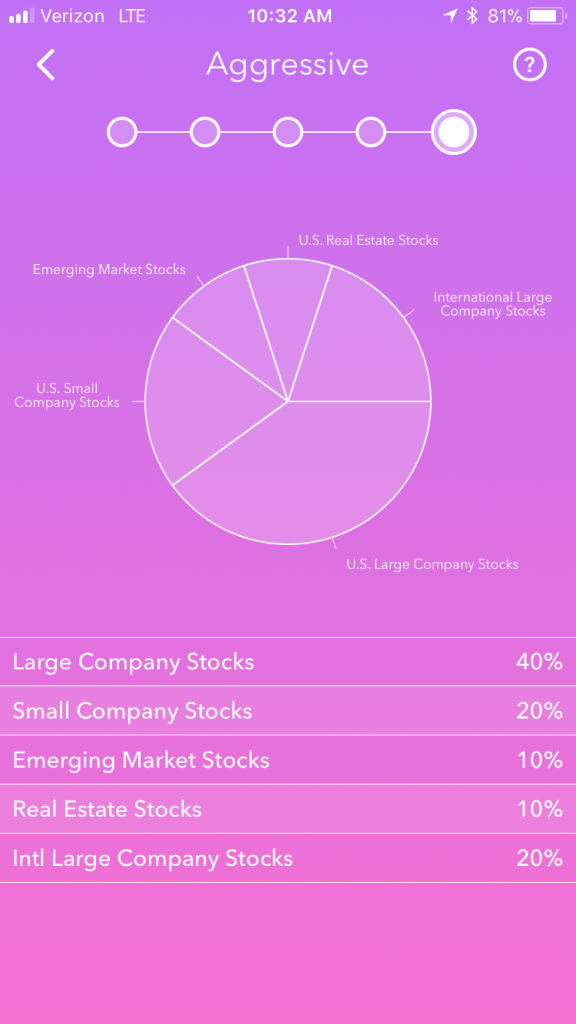

- Select your portfolio type (conservative to aggressive)

- Let the app invest your “round ups” and any recurring investments you set. You can also do any “one time” investments as well.

Here is screenshot of the “aggressive” portfolio:

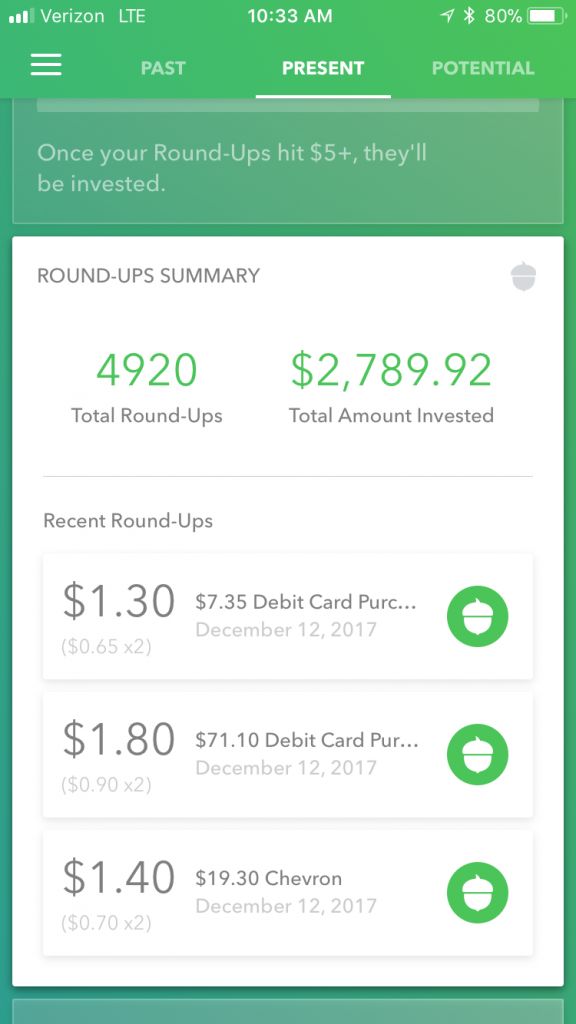

Some sample round ups (notice you can set multipliers to your roundups, mine is X2):

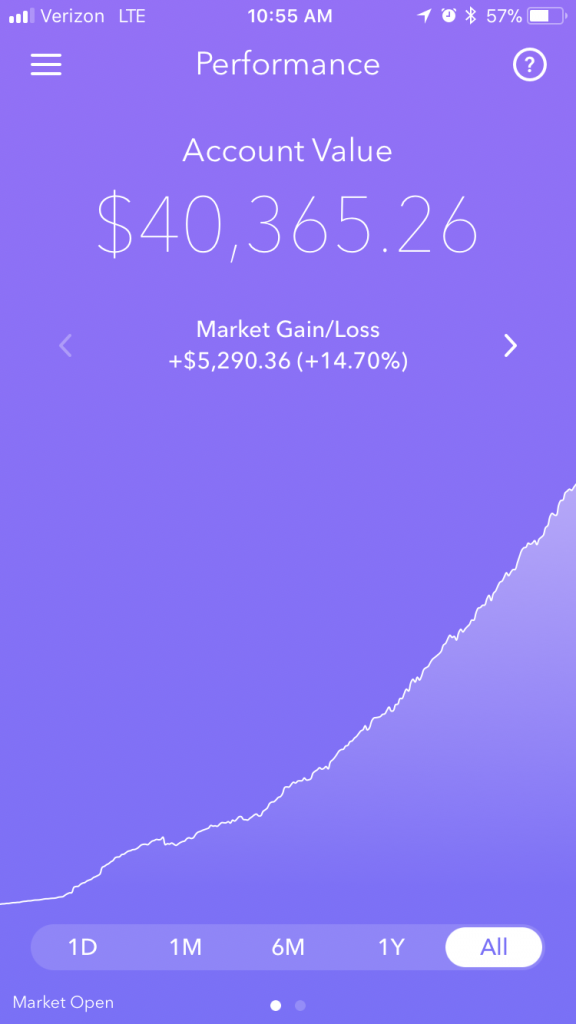

Performance over time (16.03% return):

Conclusion:

I think Acorns is a great app for beginning investors that want to start small and have a fairly set it and forget it solution. The minimal fees are nothing considering the return and the great dividends.

Benefits:

- Ability to start investing with limited funds. No huge upfront deposit needed.

- Small fees when considering the dividends more than 5x cover the fees.

- Invest any time, any amount without a fee. Some companies like Vanguard, Fidelity charge you per trade.

- Setup recurring investments so you meet your goals passively.

- Newsletter that actually has sound advice and interviews.

Sign up and start investing now and get a free $5 in your account!![]()

![]()

![]()

![]()

![]()

![]()

Financial Tips Everyone Must Read

Everyone needs financial advice at some point. Follow these financial tips to get started in the right direction.

1.Max your 401k or other employee contribution OR at least enough to get your employer’s maximum match. Don’t throw away free money. This can be thousands of dollars you are leaving on the table.

a. Know where your money is invested in your 401k (common stocks, bonds, international stocks, etc.). Choosing the wrong investments can lose you 1000s of dollars. Also if you are not checking your ira with https://www.sofi.com/roth-ira-calculator/, you might not get as much money as you have been getting.

2. Get inexpensive, well-diversified mutual funds such as those in Vanguard (VTSAX). If you can’t invest a lot, start here.

This app (get $5 just for signing up) allows you to invest small amounts to grow wealth over time. It even has a cool recurring investment feature where you can invest an X amount from your account every day/week/month. Set it and forget it. Fees are low as well.

See below how I used this app to invest a good amount with a good return in a few short years:

Sign up here and start investing today —-> I Want to Invest My Spare Change Now!

3. Save 20% of what you make. A large income does not equal wealth. Wealth is what you save, not what you spend or buy. The next financial tip is very important.

4. If you have credit cards, always pay in full every month. I only have debit cards.

5. Buy used cars in ca$h. The certified used cars these days are solid and cost a lot less. You save paying less for a used car AND no interest charges for a car loan.

6. Max out tax-advantaged vehicles like Roth, SEP and 529s.

7. Make sure you know your fees. High fees can eat away at your investment earnings. Avoid actively managed funds.

8. Only choose a fiduciary as a financial advisor.

9. Read some basic financial books:

a. “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy.”

-develops the right mindset to achieve wealth

The success stories speak for themselves in this book from money maestro Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters…

Use it for yourself or give it as a gift (makes a great wedding gift).

-great for high earning professionals especially physicians

d. “The Bogleheads’ Guide to Investing”

-a slightly irreverent, straightforward guide to investing for everyone. The book offers sound, practical advice, no matter what your age or net worth.

e. “Retire Inspired: It’s Not an Age, It’s a Financial Number”

-In Retire Inspired, Chris Hogan teaches that retirement isn’t an age; it’s a financial number an amount you need to live the life in retirement that you’ve always dreamed of. With clear investing concepts and strategies, Chris will educate and empower you to make your own investing decisions, set reasonable expectations for your spouse and family, and build a dream team of experts to get you there.

10. Read these other sources and stay educated and gain valuable financial tips. (Money Magazine, Business Insider, Kiplingers, Money Mustache, Bogleheads, The Penny Hoarder). These give investing, business and saving advice.

11. Learn what opportunity cost is and think about this in everything you purchase. It’s defined as “the loss of potential gain from other alternatives when one alternative is chosen”. For example, if you choose to buy a Michael Kors purse for $700, that is $700 that is gone forever. It cannot be invested or saved.

12. Do a monthly budget. Set average projected expenses and try to stay in those boundaries. Try to make saving and investing more joyful than spending. EveryDollar is a great tool.

13. Acquire some passive income streams. Make your money work for you by working smarter, not harder. The average millionaire has 5+ income streams.

14. Try to understand taxes as much as possible. Do taxes yourself for as long as possible (or find a good CPA). People who don’t understand the tax system never become wealthy because they don’t realize that a major way to lose money is through taxes.

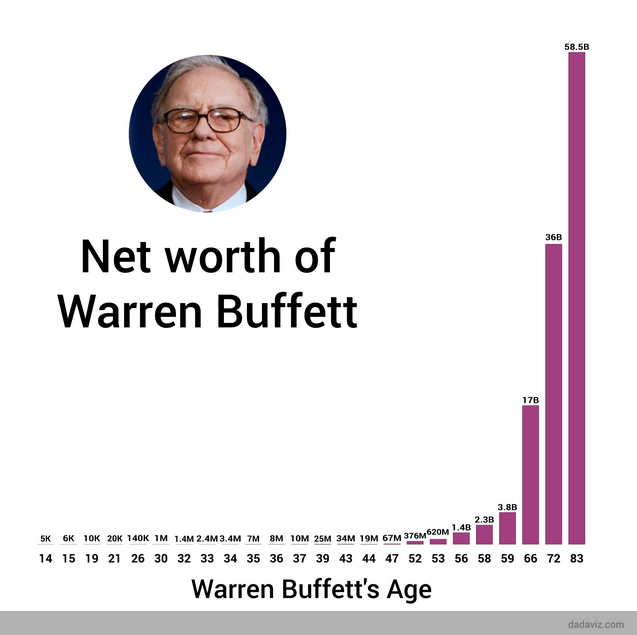

15. Understand the power of compound interest. Wealth is like a snowball that starts small for a while but sooner or later will hit an inflection point leading to big gains. Knowing this early can be better than any financial tip anyone can give you!

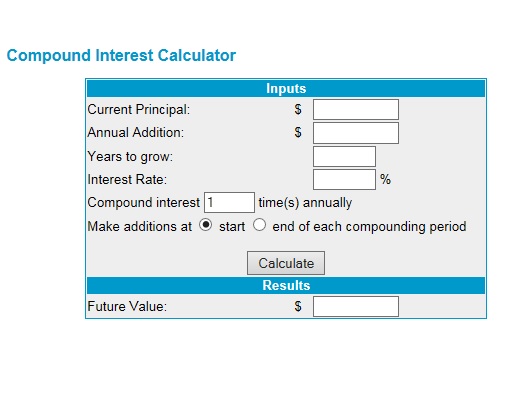

When you get depressed that your friends in the neighborhood appear “wealthy” because they are driving luxury cars and living in 5000 sq. foot houses, remember this calculator and never forget it. For example, if you chose to save $30,000 buying a reasonable car such as a Honda as opposed to a luxury car and invested that money, with a 7% interest rate and growing over 20 years, you would have $116,090.53. Click on image to use the calculator and play with some numbers.

16. Keep ALL of your receipts and know the deadlines of when you can return purchases. I used to lose a lot of money being unorganized. Some stores will only give you store credit or significantly much lower than what you paid without a receipt.

17. Don’t donate to everyone and your mother. I see people donating to every cause possible when they can barely afford to pay their own bills. Donate when you can and as much as you think you can. Nowadays, almost every major retailer tries to get a donation form you as you checkout. I just say “no thanks”. This could be thousands of dollars that you could save and invest. I am not saying to not be generous, but be generous when you can afford it and give to a cause you believe in.

18. Sign up for rewards programs and/or store debit cards with stores you visit frequently. You can get discounts, coupons and other special perks. My favorite is the Target RED card. You can get the credit or debit card. I have the debit card which saves me 5% on everything I purchase and it comes right out of my checking account. It’s secure and you even get discounts on sale items. Apply for yours here.

Benefits:

- 5% off everything in store and online. This can add up quickly if you shop at Target a lot.

- Free shipping on all online orders.

- Custom offers for what you usually shop for. Coupons for stuff you buy.

- Special promotions only for RED card holders like early Black Friday deals.

19. Avoid late fees on your bills. The easy solution is to setup auto-pay from your bank account. This will save you time and money.

20. Move. If you live in a high cost of living area, a lot of your money is going to housing, utilities and food. That can be $1000s of dollars that could be invested. Be smart about where you live.

Hope you found these financial tips useful. Now, put them into action and create a great life for yourself!

Final thoughts from a video by MJ Harris:

SHARE this if you enjoyed it and know someone who could learn from it.

What is your advice for financial security? COMMENT below.

How To Earn Your First $100K Online

Are you serious about earning money online?

Have you tried and failed?

Would you like some FREE training to properly learn internet marketing from a 7 figure earner and still be able to play?

I just got through watching the webinar and have already gotten some strategies to market online.

WATCH the webinar to discover:

- How to create more abundance and wealth in your life

- How to stop struggling financially and gain financial freedom

- How to brand yourself.

- How to get traffic using a easy 3 step method.

- How to earn $100K online even if you are broke or have no formal education

- How to run your business from anywhere in the world with just a laptop and an internet connection

- One powerful technique to earn money online by delivering value to your customers

This training is for you if:

- You are a single mom and want to do better for your family

- Have a local business and need more leads that convert to sales

- Need another stream of income to pay off debt, buy a car, save for a house, invest in the stock market or help your family

- A network marketer that has failed company after company

- Want to keep your day job and earn additional income working as little as an hour a day on the side

- You would like to earn money referring people for FREE training.

Click here for the FREE Training!

How to Get the Lowest Car Insurance Rates

You finally got your dream car or at least your first car. But, before you can take road trips or hang out with friends and create amazing memories, you’ll need car insurance. Here are some great ways to get the lowest car insurance rates:

-Different companies have different rates based on a variety of factors.

-Use an auto insurance quote finder to compare rates of the top companies.

2. Avoid Gaps in Coverage

If you are switching policies, make sure you are completely covered at all times. If you let your insurance coverage lapse by forgetting to make the premium payments, your rates are likely to be increased.

3. Maintain Good Credit

Insurance companies typically check your credit score when determining your insurance rates because they have found a correlation between bad credit and the likelihood of making a claim

4. Drive Less

Many companies offer a low-mileage discount for drivers who have a short commute or drive few miles each year.

5. Request a High Deductible

One of the easiest ways to reduce your car insurance premiums is to increase your deductible. Just make sure you have the funds to pay the deductible if you get in an accident.

6. Claim all Your Discounts

If your car has extra anti-theft or safety features such as anti-lock brakes, most insurance companies will give you a discount on your premiums. You may also be eligible for a discount if you have taken a defensive driving class or, if you are a student, you have good grades

7. Drive Safely

Of course you should drive carefully to avoid accidents and tickets anyway, but bad driving can also raise your insurance rates or even lead to a nonrenewal of your policy. While too many speeding tickets can cause a problem, causing an accident will typically raise your insurance costs by as much as 40%.

8. Consider Moving

While this may be a bit drastic, auto insurance rates vary widely from one location to another because of the likelihood of an accident or a theft. In general, car insurance rates are lower in rural areas, so you may want to look into the potential for higher or lower insurance rates if you are thinking of moving.

9. Work with One Insurance Company

After you shop around for insurance rates, choose one company for all your insurance needs. Most offer a discount for combining car and homeowners or renters insurance with one provider.

10. Lower Your Coverage

The Insurance Information Institute (III) suggests dropping collision and/or comprehensive insurance on older cars to save money. As a rule of thumb, III says that if your car is worth less than 10 times the premium, it may make sense to drop that coverage.

Conclusion

The important thing to recognize is that car insurance should be customized to meet your needs. Consulting with an insurance agent can be the best way to make sure you are taking advantage of every possible discount and that you and your car are still adequately covered.

References: Investopedia

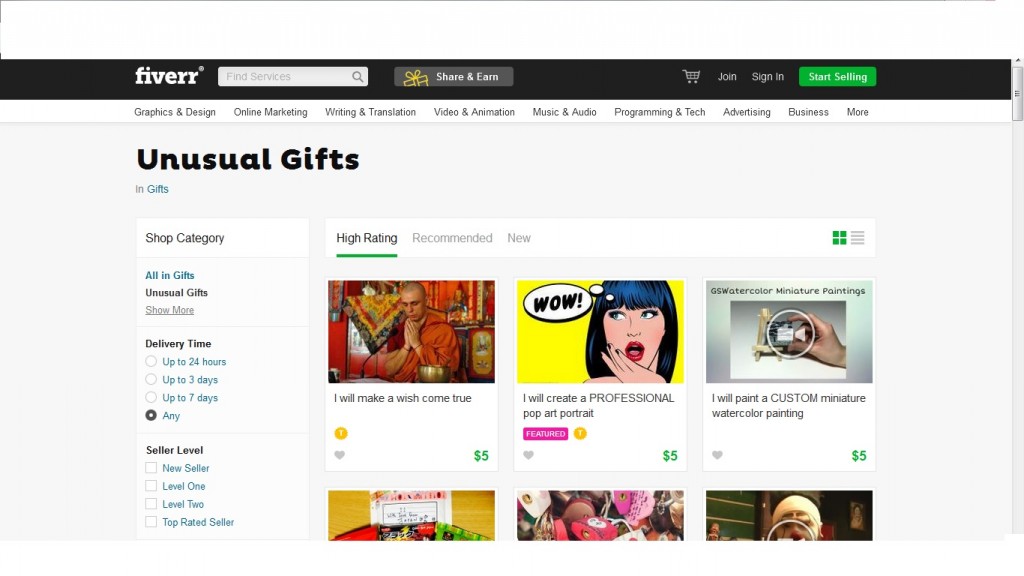

Millions of Services All Under $10 – Writing, SEO, Logo Design and Much More

![]()

![]()

![]()

![]()

![]()

![]() Need to get just about anything done? Well you can now with Fiverr. Look at some of what they have:

Need to get just about anything done? Well you can now with Fiverr. Look at some of what they have:

***Look below for CODE to get 20% off first gig.***

Get started today with top service providers today for the above services or just explore Fiverr. You won’t be sorry! Use the code FLY20 to get 20% off one time for 1st time buyers.![]()

![]()

![]()

![]()

![]()

![]()